Some fields requires to be managed by experts only. These are people with the right skills and experience to perform these duties. For instance, electrical roles cannot be carried out by just anyone. These means you must hire a professional electrical contractor in case you require this service. Due to multiple electrical contractors be certain to find one is a difficult task for most people. If you are one then here are some good news for you. There are factors that can help find the best electrical contractor. Therefore, discussed on this page are few things to note when finding the electrical contractor.

Initially, consider the reputation of the potential electrical contractor. At all costs, you must hire an electrical contractor with a positive repute. Most people consider the services the contractor offers and among others when judging their reputation. These means the electrical contractor with a good repute offers the best services to the clients. Therefore, if you choose their service you can be able to enjoy the same service. Here you are supposed to ask more about the reputation of the potential electrical contractor. You can ask people who have employed them in the past. Still, you can find few comments on their social media pages.

The next aspect you should be the wage of the electrical contractor. There are no free services today. Therefore, you must be ready to spend extra cash to hire the best services. Here you are required to do your financial plan. Then you have to set a day aside to go to various electrical firms and inquire about their charges. This is to ensure you choose the one you can afford to wage. It is possible to meet all the available electrical contractor have unaffordable wages. Here, you must ask one for a discount to evade overspending and going through financial problems.

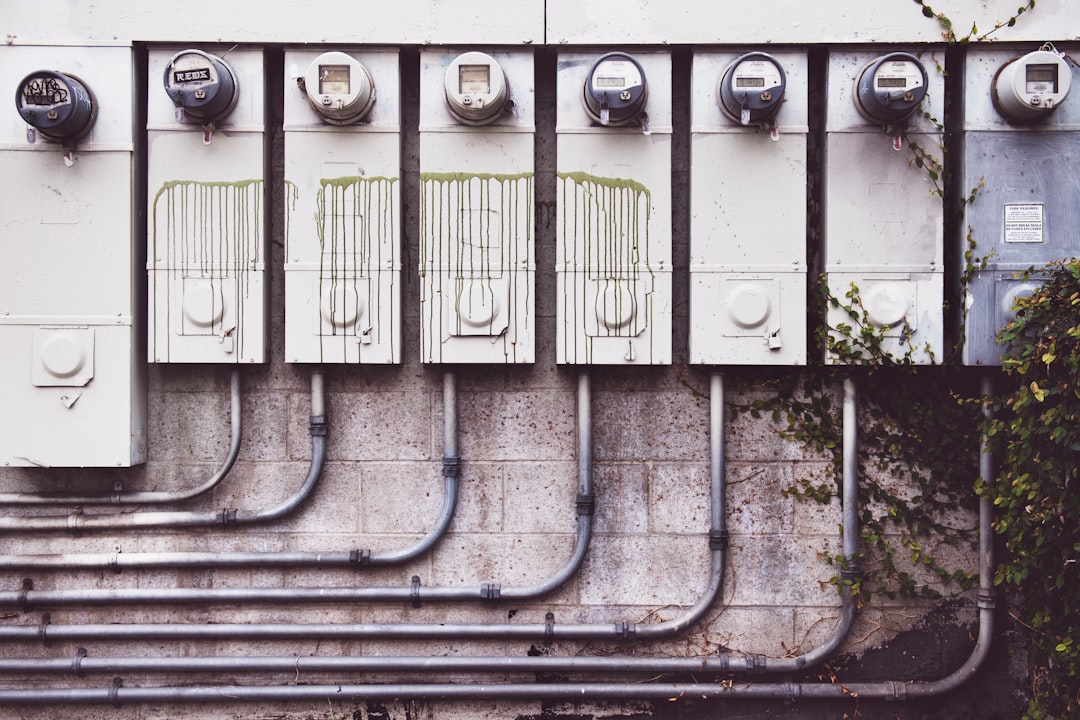

There are tools that every electrical contractor must have to be able to carry their roles effective and within a short while. In this case, you must pay attention to them. You must hire an electrical contractor who has these tools of you want perfect results. At this point, it is wise to ask to see these tools before you can sign a contract. Create ample time to go to the firm to see these tools. If you don’t know about how these tools look like then you can use the Internet for more details. Consider if they have similar physical characteristics. If they do, then, you can trust the service of this particular electrical contractor.

The last thing should be the professionalism of the electrical contractor. A slight mistake on these roles be sure to cause severe damages and losses to the property owner. Therefore, you must be cautious when choosing one. Ensure they have gone through the needed training from a popular and commendable training center. Check the their results slip since there are people who give false information to secure the job.